are delinquent property taxes public record

Tax Record Search and Online Payments Spartanburg County Taxes pageDescription. A New Jersey tax lien certificate transfers all the rights that come with being the owner of the real estate tax lien from Middlesex County New Jersey to the.

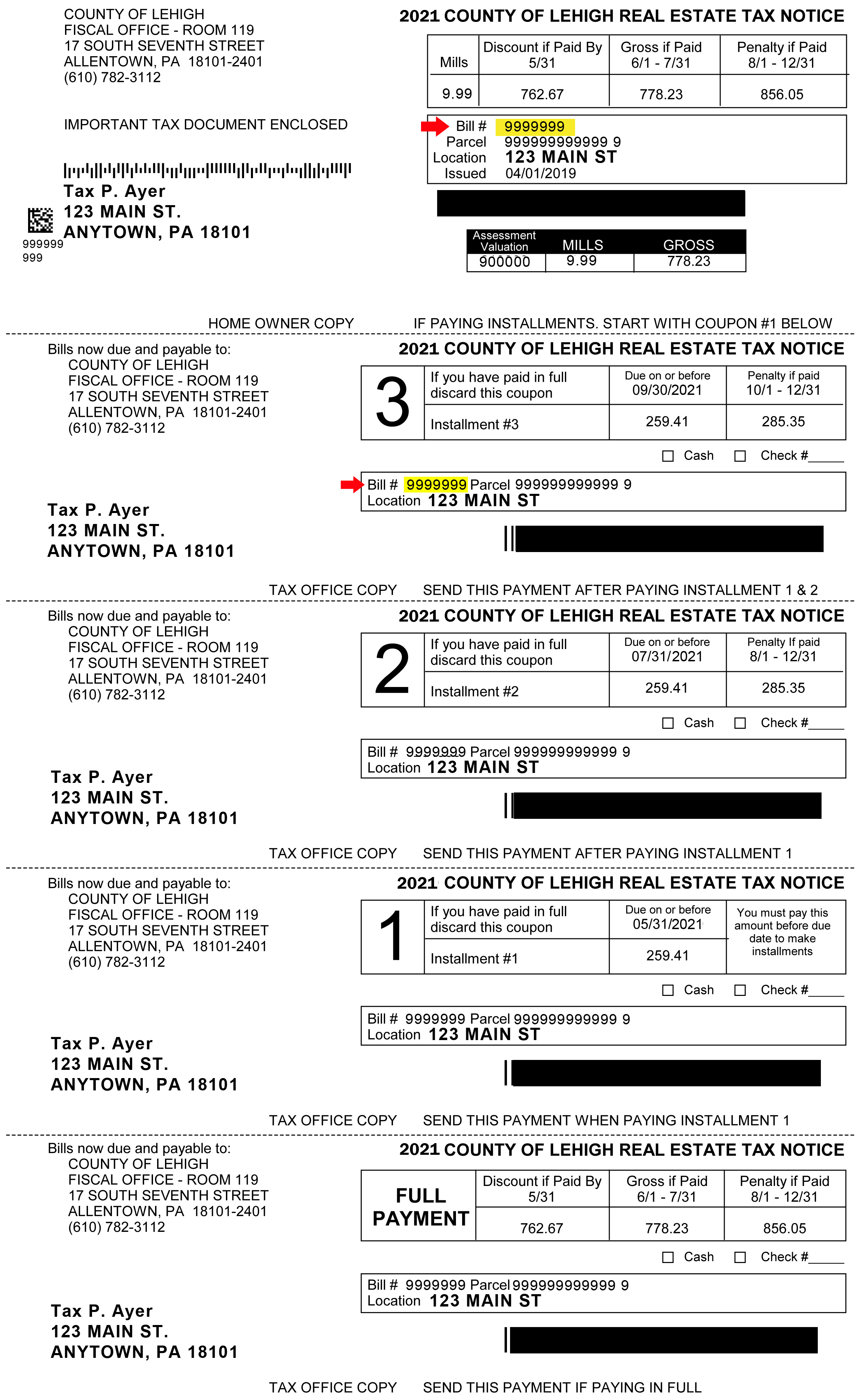

How To Read Your Property Tax Statement Snohomish County Wa Official Website

For Reno County such sales usually occur in the fall of each year.

. Delinquent Tax Department Brett Finley Phone. She joined ATC in 2005 and held various positions in the Internal Audits and Property Tax Divisions. Information on property tax calculations and delinquent tax collection rates.

Seizes property for non-payment in. 803 785-8345 Real Estate Taxes. All taxpayers on this list can either pay the whole liability or resolve the liability in a way that satisfies our conditions.

1055 Monterey Street San Luis Obispo CA 93408. Tax Records include property tax assessments property appraisals and income tax records. Typically a tax lien is placed on the property by the government when the owner fails to pay the property.

SANTA CLARA COUNTY CALIF The Department of Tax and Collections DTAC representatives remind property owners that the first installment of the 2022-2023 property. Theres a new system for handling. Official Tax Rates Exemptions for each year.

WSAZ - Cabell County Sheriff Chuck Zerkle is giving a heads up to tax payers to stay on top of their property taxes. 1055 Monterey Street San Luis Obispo CA 93408. 105-3651 b 1.

1 day agoHUNTINGTON WVa. Certain Tax Records are considered public record which means they are available to the. Failure to redeem the property within this time period will result in tax foreclosure and the sale of the property at auction.

The Tax Collectors Public Service Office located at 200 NW 2nd Avenue Miami Florida 33128 is open Monday through Thursday from 830 am. Please check your delinquent. At the close of business on April 15th the tax bills are transferred from the sheriffs office to the county clerks office.

Interest of 56 of 1 per month plus 2 penalty must accompany delinquent taxes paid after due dates. A prior owner who was not the record owner as of January 6 may not be held personally responsible for taxes on the real property in question. 1055 Monterey Street San Luis Obispo CA 93408.

For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000. The Delinquent Tax office investigates and collects delinquent real property taxes penalties and levy costs. Public Act 123 of 1999 shortens the amount of time property owners have to pay their delinquent taxes before losing their property.

Delinquent tax records are handled differently by state. A tax lien is simply a claim for taxes. The Tax Office accepts full and partial payment of property taxes online.

Finds and notifies taxpayers of taxes owed. Linda Santillano has served as Property Tax Division chief since October 2017. Excise Taxes Online Services X Rules Policies Administration Alcohol Tobacco Income Tax Local Government Motor Fuel Motor Vehicle Recording Transfer Taxes Sales Use Taxes.

This amount must be obtained by contacting the Treasurers office PRIOR. And on Fridays from 830 am. Deadlines for Property Taxes.

They are then known as a certificate of. Have not paid their taxes for at least 6 months from the day.

Investing In Property Tax Liens

Home Real Property Tax Services

How To Find Tax Delinquent Properties In Your Area Rethority

Treasurer S Office Westmoreland County

Property Tax Process Mendocino County Ca

How To Find Tax Delinquent Properties In Your Area Rethority

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

County Of Midland Michigan Treasurer Property Tax Information

More Than 12 000 Tax Delinquent Properties In Arkansas Set To Head To The Auction Block Katv

Home Constitutional Tax Collector

Sanpete County Treasurer Sanpete County

How To Find Tax Delinquent Properties Mashvisor